Electric vehicles (EVs) are popular right now and the publicity around the tax concessions are supercharging this interest. As the adoption of electric vehicles continues to grow, it is essential to understand the tax implications associated with owning one of these vehicles.

Just in time for the Fringe Benefits Tax (FBT) year, which started on 1 April, the Australian Taxation Office (ATO) has released new details on electric vehicles.

q4 has outlined these details on what you need to know.

FBT exemption for electric cars

If your employer provides you with the use of a car that is classified as a zero or low emissions vehicle there is an FBT exemption that can potentially apply to the employer from 1 July 2022, regardless of whether the benefit is provided in connection with a salary sacrifice arrangement or not. The FBT exemption should normally apply where:

- The value of the car is below the luxury car tax threshold for fuel efficient vehicles ($84,916 for 2022-23) when it was first purchased. If you buy an EV second-hand, the FBT exemption will not apply if the original sales price was above the relevant luxury car tax limit; and

- The car is both first held and used on or after 1 July 2022. This means that the car could have been purchased before 1 July 2022, but might still qualify for the FBT exemption if it wasn’t made available to employees until 1 July 2022 or later.

The exemption also includes associated benefits such as:

- Registration

- Insurance

- Repairs or maintenance, and

- Fuel, including electricity to charge and run the vehicle.

But, it does not include a charging station (see How do the tax rules apply to home charging units?).

While the FBT exemption on EVs applies to employers, the value of the fringe benefit is still taken into account when working out the reportable fringe benefits of the employee. That is, the value of the benefit is reported on the employee’s income statement. While you don’t pay income tax on reportable fringe benefits, it is used to determine your adjusted taxable income for a range of areas such as the Medicare levy surcharge, private health insurance rebate, employee share scheme reduction, and certain social security payments.

Who the FBT exemption does not apply to

By its nature, the FBT exemption only applies where an employer provides a car to an employee. Partners of a partnership and sole traders are not employees and cannot access the exemption personally.

If you are a beneficiary of a trust or shareholder of a company, the exemption can only apply if the benefit is provided in your capacity as an employee or as a director of the entity (you need to be able to show you have an active role in the running of the entity).

How do the tax rules apply to home charging units?

The ATO has confirmed that charging stations don’t fall within the scope of the FBT exemption for electric cars. This means that FBT could be triggered if an employer provides a charging unit to an employee.

If an employee purchases a home charging unit then it might be possible to claim depreciation deductions for the cost of the unit over a number of income years if the unit is used to charge a vehicle that is used for income producing purposes. However, if an employee is only using the vehicle for private purposes then the cost of the charging unit is a private expense and not deductible.

What about the cost of electricity?

“A friend of mine travels a lot for work and used to rack up large travel expenses…right up until he switched to an electric vehicle. Now it costs him 3 cents per km in electricity.” This is now becoming a common story we hear from clients and friends.

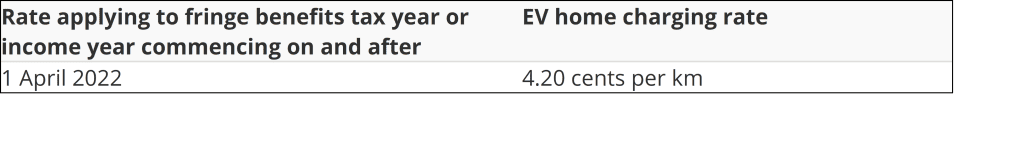

Because it is often difficult to distinguish home electricity usage, the ATO has set down a rate of 4.20 cents per km for running costs for EVs provided to an employee (from 1 April 2022 for FBT and 1 July 2022 for income tax).

If you use this rate, you cannot also claim any of the costs associated with costs incurred at commercial charging stations.

It is one or the other, not both.

You also have the option of using actual electricity costs if you can calculate them accurately.

If you have more questions and would like to discuss how this may affect you, please contact us today.